Turning In-Store Shoppers into Monetizable Audiences

Walk into any grocery store today, and you will see kiosks, screens, cooler doors, shelf panels, and edges vying for your attention with prices, deals, and bundling reminders. Undoubtedly, they look great and help shoppers make better buying decisions at the point of sale.

However, they do not give advertisers what they really want and value. Real-time shopper targeting and campaign measurement.

In fact, there has never been an easy and reliable means to accurately understand, quantify, value and influence in-store grocery shoppers’ behavioral patterns and purchasing habits.

As a result, despite the inherent demand for smart targeting of ads at the point of purchase, and direct access to high-intent shoppers at scale, very few retailers are able to convert this demand into incremental ad revenue.

However, the unprecedented and exponential rise of ‘Retail Media’ makes this revenue opportunity too significant for retailers to ignore.

In-Store is the Challenge – and Opportunity for Grocery Retail

Ask any retailer today what Retail Media means to them, and they will likely say it represents a new high-margin revenue opportunity in a traditionally low-margin industry.

And they’re right.

Brands are willing to pay a premium for both precision-targeting audiences at the point of sale and get an immediate and verifiable performance measurement.

No wonder Retail Media budgets crossed $100 billion in 2022 and continue soaring. In response, retailers rush to set up Retail Media teams, start booking ads, and get these new advertising dollars flowing in.

However, most efforts focus on online Retail Media because it gives advertisers what they want and value.

For grocery retailers, however, it’s just not enough.

Counter-intuitive as it may seem, for grocery retailers, success with Retail Media will depend on their in-store audience capabilities.

Here’s why.

A Closer Look at the Numbers: Grocery Retail Audiences

Today, most grocery retailers will agree that nearly 80% of their shoppers are exclusively in-store. In reality, the number is likely higher if you count multi-channel shoppers who buy both online and offline.

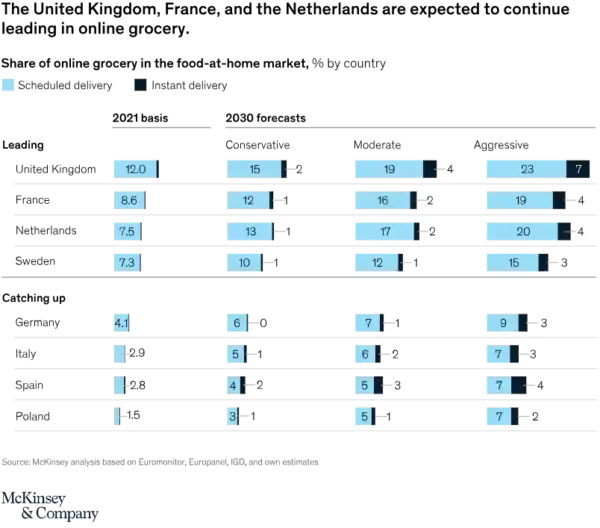

But what about the rest of the decade? The recent McKinsey research report predicts that, on average, 80% of European grocery- and FMCG shoppers are and will be in-store shoppers, even well into 2030. Numbers for the US are similar.

Even the most advanced market in the region, the UK, will not see more than 20%-30% of grocery shoppers move to shop exclusively online. And that is the best case. The moderate estimate is 23%, and the conservative 17%. This means that even at the end of the decade, Europe’s most tech-savvy grocery market will still have at least 75% of its shoppers in physical stores.

The numbers will change even less if you look at other major European markets. For instance, 88% of the purchases in Germany will remain in-store. For France, the prediction is 77%, and even in the Netherlands, which is quite digitally advanced, 76% of grocery shoppers will remain in-store, even by the turn of the decade.

When it comes to FMCG, groceries, and fresh food, people continue to prefer physical stores to discover new products, touch and feel products, and find cheaper or local alternatives and deals.

The conclusion is straightforward. Despite the boom in digital shopping, in-store shoppers are more relevant for FMCG and grocery brand advertisers than ever before.

What Does This Mean for Grocery Retailers?

Retail Media budgets will flow to omnichannel networks where advertisers can reach and precision-target shoppers across the entire path-to-purchase, online and in-store. With 80% of shoppers in-store, this is obviously a crucial channel to capture.

Advertisers know this but cannot justify shifting budgets from other media channels yet, because traditional in-store media solutions lack real-time shopper targeting, campaign measurement, and a comparable media currency that can be used for a more seamless media planning and buying experience.

In-store Retail Media must evolve. To create a compelling case and win Retail Media budgets, brick-and-mortar retailers must find a way to target shoppers in real-time, at the point of influence, and capture and monetize in-store shopper data.

Why do current in-store media solutions fall short of FMCG advertisers?

- Current static displays, such as shelf edges, posters, and flyers, are not measurable or engaging.

- Current digital signage takes it a notch higher with historical campaign data, but much of it is inferred data, arrived at by comparing and correlating various parameters, including mobile and purchase data. Unlike Online Retail Media, they do not enable individualized messaging, near-real-time performance analytics, or on-the-go campaign optimization.

How to Digitize and Monetize In-store Audiences

Imagine if you, as a brick-and-mortar grocery, health/beauty, or fresh food retailer, could offer advertisers the chance to target in-store shoppers, in real-time, with dynamic creatives. And then provide advertisers verifiable performance metrics and campaign analytics.

In short, if you could offer advertisers all the success factors of online Retail Media with in-store shoppers.

A new generation of In-store Retail Media solutions is doing just that.

Among those, Advertima’s Audience AI is the most technologically-advanced solution to monetize in-store shoppers.

How Advertima Works

- When a shopper walks into a retail store and steps in front of a screen, the Computer Vision powered system captures and digitizes their anonymous visual and contextual attributes.

- The AI-powered ad-serving system then matches the digitized shopper with pre-defined seller segments and serves the best-match ad all within milliseconds.

- While no personally identifiable information (PII) is collected, the system measures performance indicators such as movement, dwell time, and attention for each playout.

- If there is more than one person in front of the screen, the system determines the dominant group demographics and serves the right ad to appeal to an individual or group of people. It’s an online-like tailored ad experience delivered in a one-to-many retail environment.

The Time to Act is Now

Today’s grocery retailers are sitting on a highly prized commodity in the eyes of the media buying industry (and have been for years).

Providing advertisers access to in-store audiences with real-time targeting and transparent, validated metrics will undoubtedly unlock new revenue streams that, until now, have largely been overlooked – not due to any perceived insignificance, but because of inadequate audience measurement standards.

With advanced technologies such as Advertima’s Audience AI, grocery retail will become a relevant and coveted media channel for brand owners.

73% of US retailers are planning to increase in-store technology investments for 2022. These retailers have already taken the leap and have seen high-margin, incremental Retail Media revenues in a short period of time.

You can too.

Download the free White Paper.

Get additional insights and learn more about how retailers can transform in-store shoppers into monetizable media audiences and unlock their full potential right now.