Updated, October 03, 2023

Retail Media is Filling the Gaps in a Post-Cookie Ad World

The loss of IDs has severely impacted the ability of digital advertising to deliver measurable reach at scale.

With addressable digital audiences shrinking and linear TV audiences dropping away in favor of streaming services, brands are looking for new channels to overcome this gap.

CTV is promising, but there is also the need for channels closer to the point of purchase.

Online Retail Media, powered by digital audiences, quickly emerged as a winner. It zoomed to global spending of $100 billion, giving advertisers exactly what they needed: reach at scale to addressable shopper audiences as close to the POS as possible.

As a result, walled gardens such as Amazon and other global, national, and regional retailers moved quickly to build some form of online Retail Media and win these rapidly expanding budgets.

But The Biggest Retail Media Opportunity is In-store, not Online

As the pandemic fades into the distance, people have returned en masse to physical stores. eMarketer’s 2024 In-Store Retail Media report reiterates that more than 80% of actual retail sales happen in physical stores rather than online. And while most retail media ad spending will take place online, most retail sales will take place in physical stores. eMarketer’s 2023 report found that, on average, in-store audiences for the top 13% of retailers are 70% bigger than their digital audiences.

The data is even more compelling for regional and local retail players who see more frequent and higher in-store traffic than digital. McKinsey also predicted that, on average, 80% of European grocery and FMCG shoppers are and will be in-store shoppers well into 2030.

With advertisers demanding incremental reach among addressable audiences, grocery retailers with strong ‘online-only’ Retail Media are monetizing their digital audiences and seeing revenue flow. But according to the research, that’s only 20% of the potential.

Imagine the revenue opportunities if grocery retailers could harness the other 80% of in-store shoppers with the same strategies they apply to activate their online audiences. By making 100% of their audience addressable, retailers would accelerate those high-margin Retail Media revenues.

But until now, it’s proven to be challenging.

The Potential of In-store Retail Media is Untapped. But is it also Unreachable?

Identifying the Roadblock for In-store Retail Media Growth

Expert opinion and the data above show that the next wave of Retail Media growth, especially for CPG and grocery retail, will come from In-store Retail Media. It is a compelling proposition for both – brand advertisers seeking incremental reach and retailers seeking new sources of high-margin revenues.

So why aren’t In-store Retail Media budgets growing as rapidly as they should?

Because the promised growth can only come when In-store Retail Media is able to match the benefits and performance of online Retail Media.

The truth is that current in-store media offerings simply lack the sophisticated audience segmentation, targeting, and measurement capabilities that advertisers are accustomed to online.

Traditional location and loop-based playouts, retroactive performance measurement, and limited audience insights just don’t inspire the same confidence to attract the big Retail Media budgets!

That is why, despite the availability of a huge audience in-store, most in-store media cannot offer “real-time” addressability of shoppers based on segments that are relevant for advertisers.

This weakens the business case to shift incremental advertising dollars towards in-store.

Audience Segmentation Can Unlock In-store Retail Media’s Untapped Potential

Online Retail Media offers addressability and measurement. But misses 80% of shoppers who are in-store.

Classic In-store Retail Media offers reach. But lacks real-time addressability of shopper segments or measurement capabilities for in-store campaigns.

Stuck in the middle are advertisers who want access to the billions of in-store shoppers but also demand online-like Retail Media capabilities to commit bigger budgets.

The gap between advertiser expectations and current In-store retail media offerings can only be bridged by:

- Bringing online-like real-time audience segmentation, targeting, and measurement capabilities in-store

- Using the media currency advertisers are used to – addressable reach and real-time audience segments

- Enabling seamless buy and sell via the existing ecosystem

Access to Incremental Reach and Revenue from In-store Retail Media is Finally Within Reach

Advertima’s Audience AI finally makes in-store audience reachable and addressable in real-time.

All with a seamless buying experience, using media currency everyone in the ecosystem understands – addressable reach and audience segments.

For advertisers used to online Retail Media, this is exactly the kind of In-store Retail Media solution they have been waiting for.

With Advertima’s proven ‘real-time segmentation targeting’ capabilities, retailers can

- Provide advertisers access to addressable real-time in-store audience segments,

- Unify those segments with online audience segments for true omnichannel Retail Media planning and buying,

- Deliver a scalable solution to unlock the full revenue potential of their in-store audience.

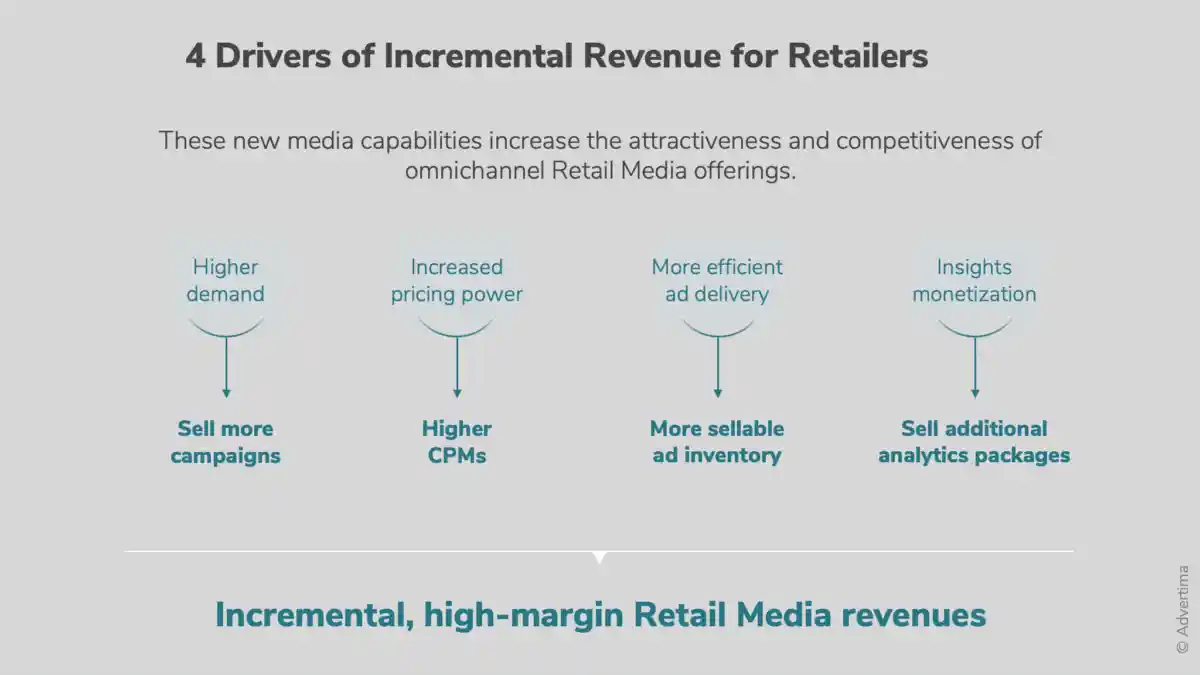

4 Ways Advertima Delivers Incremental Gains for Retailers

#1 Higher demand: sell more campaigns

Earn incremental revenues by plugging into the omnichannel Retail Media Network (RMN)

Campaigns are never planned for just one channel. However, planning for multiple channels needs a comparable media buying currency across channels.

Traditional in-store media, planned and bought based on proxy data, location, or the number of playouts, typically receive lower budgets because they are siloed from mainstream Retail Media planning and buying.

With Advertima, In-store Retail Media can be planned and bought based on audience segments — a familiar media buying currency, via the same omnichannel RMN where they also plan and buy onsite and offsite campaigns.

Addressable audiences and a streamlined buying ecosystem create new demand and beings in budgets that may otherwise have gone elsewhere.

#2 Increased pricing power: higher CPMs with audience segmentation

Earn incremental revenues by creating higher-value ad inventory

Because each playout is targeted in real-time, ads reach more of the right audience in each defined target group than generic loop-based layouts.

Advertima’s AI-based segmentation combined with locations, time of day, and standards such as the IAB content taxonomy help campaigns reach more addressable audiences within the same period of time.

This increases the value of each playout and allows a premium for the in-store media inventory.

#3 More efficient ad delivery: more sellable ad inventory

Earn incremental revenues from the same number of screens.

Real-time segmentation targeting makes more efficient use of in-store media inventory, such as smart digital signage.

When campaigns achieve their reach goals across specific audience segments with fewer playouts, it reduces wastage, frees up ad slots for additional playouts, and drives incremental revenues over the same time period and number of screens.

In addition, as Advertima AI attributes can fit a variety of specific brand-defined audience segments, it creates more sellable inventory across a wider variety of campaigns.

#4 Insights monetization: sell additional analytics packages

Create new revenue with audience insights.

Advertising channels with access to the best, latest, and most verifiable metrics and data always win big budgets.

In-store media ads are usually booked as time slots based on historical audience data such as loyalty cards, cashier data, or campaign analytics. This can’t compare to online retail media, which offers real-time data flow from ongoing campaigns as a basis for planning and booking inventory.

With Advertima, retailers can give advertisers real-time verified metrics about segment-specific audience reach, impressions, and engagement (ad interactions), like in the online world.

Based on this real-time performance data, advertisers can optimize campaigns, and retailers can gradually improve and monetize audience insights.

Bots can’t enter stores and pretend to browse or shop

As a bonus, measurable In-store Retail Media is not impacted by the massive ad fraud challenge currently faced by the industry. Advertima’s Audience AI verifiably captures, monetizes, and measures 100 % of in-store shopper traffic.

Following the Customer Journey with an Omnichannel Retail Media Network

With third-party cookies gone, online audience addressability is shrinking. Retailers offering only on-site and off-site audiences will lose not only out on 80% of their reach potential but also their earning power.

No doubt, In-store Retail Media is set for sky-rocketing growth.

But that growth will only come to retailers that offer a stand-out In-store Retail Media solution that checks all the boxes. Real-time audience segmentation, addressability, measurement, and audience insights; brand safety and privacy compliance; high-quality shopper experiences; enabled by a comparable media buying currency and seamless programmatic access to inventory.

With Advertima’s Audience AI, all of this is finally possible.

But the surest and longest-lasting path to Retail Media success is not from any one channel alone.

To compete with walled gardens, retailers must offer brands and advertisers a full-funnel, omnichannel Retail Media Network (RMN). The seamless buying experience should include unified targeting through the shopper’s entire journey – in-store, onsite, and offsite.

To know the exact steps to build a stand-out In-store Retail Media solution and integrate it with your omnichannel Retail Media Network,

Download the free White Paper.

Get additional insights and learn how retailers can transform in-store shoppers into monetizable media audiences and unlock the full potential of omnichannel Retail Media right now.